|

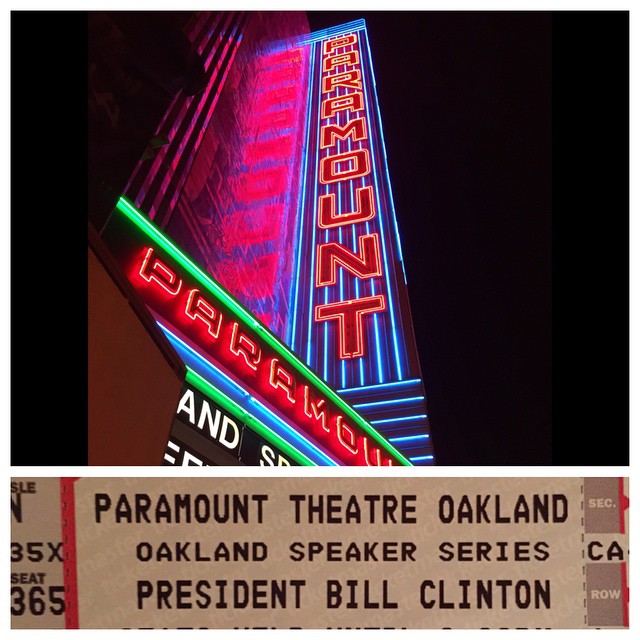

"Congratulations, you have been accepted into the Oakland Speaker Series," the email stated, "please send us an updated credit card."

FINALLY! I've been trying to get tickets for the last five years and have been politely rejected each time due to the long waiting list and the process of seniority (of which I have none). Thus, I'd nearly given up all hope at ever securing these highly-coveted seats and consequently, was nicely surprised when I received notification last week that at long last, I had made the cut. Isn't it nice to know that perseverance pays off in the end? (Yes, it is.) For those of you who've never had the good fortune to attend The Oakland Speaker Series, it's a forum for the nation's most relevant and engaging speakers: former white house staff, retired presidents, world leaders, captains of industry, tech geniuses, policy makers, and your not-so-average newsworthy movers and shakers! Thanks to friends who have graciously invited me when a spare ticket presents, I've rarely ever left an event without feeling that my IQ had just been elevated a point or two. Man, it's hard work being intellectual . . . The fact is, that in a market that's increasingly difficult to navigate, being smart about the choices we make, can be a difficult line to walk. Don't tell my broker, but I'm just as often trying to talk my clients OUT of a house, as into one. Really? (Really.) At a recent escrow closing, my darling Buyers joked that they were signing the papers, in spite of my frequent protestations (guilty as charged). In my defense, I know it's your money, your risk, and your decision, but because I've had enough experience to watch the market swing in both directions, I not only need to encourage you to be brave, to give you permission to buy, and to bid aggressively, but to be smart about the choices you make and to consider them carefully. (In the end, these buyers followed their heart, which was really the most persuasive factor.) I'm not suggesting that now is the time to pull back and get conservative (it isn't IF owning a home is the intended goal) but when you consider a home purchase, you need to look at this investment not only as a Buyer, but as a Seller as well. Thus if you end up paying a premium in a hot, hot, HOT marketplace (and you most likely will) you' wil be far better served IF the home you buy in today's world, has comparable value down the line for the next prospective owner to come. (Footnote, if you plan on staying in the house 10-20 years, what you pay in today's world is almost irrelevant, BUT if you think it is very likely you will move again in less than five, the price you pay TODAY is HIGLY important.) Even so, buy high or buy low, you still want to make a smart decision, no matter the purchase. As I explained to one hopeful builder looking for the "bargain buy" - "$10,000 for an unbuildable lot is just expensive dirt." Or to another: "I know this fixer property seems like a good deal by comparison," my email began, "but beyond a fair amount of space, it's lacking natural light, a good floorplan, a usable yard, and a desirable location. I just don't think there are enough check marks in the plus column to make the savings worthwhile." (Happily, they walked away.) Which isn't to say that I don't love and encourage a "fixer" purchase - I do (I'm the queen of fixers; renovationriptide.com) but that smart Buyers select the TLC home with clarity and care and at the very least, a "fixer" home should start with good bones because renovation is exceedingly expensive under the best of circumstances (take it from one who knows) AND rarely pencils out unless you're a professional flipper by trade. Conversely and under much different circumstances, I have no problem fighting for a house and challenging my Buyers as to their concept of "value" when appropriate, and have often done so!Given that I have tracked the market for years on end - not weeks - it's a fair bet that I have a better sense of where a home will ultimately trade and where the current market value lies. "I'm going to encourage you to bid more as I believe this home is well worth it and here's why. . ." However, whether a "fixer" or a "turn-key" opportunity, the old adage, "location, location, location" has never been more true, but with one interesting, new caveat - upcoming and transitioning neighborhoods may in fact, provide the greatest value in upside potential and future returns. As an example, The Temescal neighborhood in Oakland is enjoying an unprecedented boom in property values that only a few short years ago would have been unimaginable. "Walk-to," commuter neighborhoods such as these are highly, HIGHLY desirable and in much demand. So how do I know what's worth pursuing and what isn't? The "value proposition" of any home is ultimately up to you (not me). For some it's a bay view, for others it's public transportation and for still others, it's good public schools; the value and worth of one's home are as varied as the properties themselves, but this does brings us to the discussion of 'inherent' vs. 'correctable' flaws that I am asking you to carefully consider . . . Starting with the premise that NO home is perfect, let's acknowledge that a home that sits on the BART line is ever thus (inherent flaw), but a home that is short a master bathroom might reasonably rectify that shortcoming with relative ease (correctable flaw). Ugly paint colors and old carpet? That's a no brainer and a relatively cheap fix. (Correctable!) Lack of light? Skylights, windows, and tree trimming might be your answers. (Correctable.) A wonky floorplan? A good architect is a powerful ally as long as you have space to work with. (Correctable.) No yard? That may be tougher. If the lot drops away, you may be limited to decks, but if there's land to be grabbed, think front or side courtyards, moving a fence, or building strategic retaining walls. Yes, creating a yard by moving the earth is doable, but it's a sizable investment to be sure. (Maybe correctable, maybe not.) Fifty stairs to the front door? Sorry, you'll need strong thighs and a hearty soul. Short of an elevator, that's nearly an impossible fix. (Inherent.) "But Julie, we're going to live in our home forever." Okay then, problem solved. Listen, all homes - no matter their flaws - sell under the right circumstances and gratefully, nearly everything is trading with multiple offers in today's marketplace. But just because you've lost a home, or two, or three, OR four . . . avoid the temptation to get seduced into a purchase that's going to be expensive or difficult to either "fix" or sell down the road should the market shift. When it comes to your home purchase - with patience, diligence and perseverance, we are going to find the right "fit." I'm certain of it. While it may be difficult to believe so after losing a house you had your heart set upon, there will absolutely be another option soon and more often than not, it proves the better choice. Let's play it smart! How can I help you?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorJulie Gardner, has been writing The Perspective for 18 years and has published more than 750 humorous but always informative, essays on life and real estate. Categories

All

|

RSS Feed

RSS Feed